Best Home Insurance Companies

- Homeowner

- /

- Best Home Insurance Companies

Whether you’re a first-time homeowner or looking to switch your home insurance company, it can be overwhelming to sift through the hundreds of options on the market. A house is a precious asset, and it can be tough to discern which company has the best home insurance for you.

For most people, the best homeowners insurance company will be a provider that offers a low rate for great coverage. Let’s look at where to get homeowners insurance, the best homeowners insurance companies, and the best home insurance deals.

Where to Get Homeowners Insurance

Where you can get homeowners insurance will largely depend on where you live. While some homeowners insurance companies have a broad national footprint, others may only serve specific states or regions. It is always a good idea to assess all your options, as your state may have a local home insurance provider that suits your needs much better than any of the providers highlighted in this article.

When sifting through the many home insurance companies that offer coverage, you will also want to remember what’s right for you. New homeowners may be best suited to one home insurance provider, while experienced homeowners might find a different home insurance company is best for them. Similarly, if you want the best savings, the best homeowners insurance company for you may differ from someone focused on getting extended coverage.

It’s Time to Switch Your Homeowners Insurance

We partner with the nation’s top homeowners insurance companies so you can get a custom policy at an affordable price.

Best Homeowners Insurance Companies

The best house insurance companies will typically have a prominent footprint in your area, offer several discounts, and provide various coverage options for low prices with a low deductible. Sounds too good to be true, right? Well, it isn’t. With some research on your end, you should be able to get the best home insurance provider for you with the best deals.

The Top 10 Home Insurance Companies

After some meticulous research here on our end, we’ve compiled a top 10 list of home insurance companies in the U.S.. These are Clovered’s picks for the top 10 home insurance companies in the U.S.:

1. State Farm

State Farm offers exceptional national coverage, extending throughout all 50 states. Unlike many broad, national home insurance providers, they provide policies for homes in high-risk areas, like those susceptible to wildfires and hurricanes. State Farm offers excellent coverage options, making them a great choice for new homeowners and seasoned veterans alike. State Farm is Clovered’s top-rated homeowners insurance company.

State Farm

Pros

- Discount for bundling home and auto insurance

- Competitive rates before discounts

- High J.D. Power and AM Best scores

Cons

- Fewer discounts than competitors

- Higher-than-average customer service complaints

2. Allstate

Allstate ranks high on our list of homeowners insurance companies for its prominent national standing, customizable policies, and various discounts available for homeowners. Policyholders with Allstate consistently rate their customer service higher than average and consider it one of the highest-rated home insurance companies.

Allstate

Pros

- Protection against raising rates after claims

- Many discounts available (multi-policy, paying on time, etc.)

- Longstanding homeowners insurance company

Cons

- Base policy prices slightly higher than average

3. Nationwide

Nationwide is a homeowners insurance company with higher-than-average customer service ratings and is especially notable for offering low rates on homes of high value. Nationwide also offers a wide selection of discounts and add-on coverages and is available in nearly every state.

Nationwide

Pros

- Quick and easy claims process

- App is easy to use

- Offers coverage for most types of homes and income levels

Cons

- Not available in every state

4. Travelers

Travelers is the oldest insurance company, founded in 1853, and has learned a thing or two throughout the years about providing excellent insurance. Travelers offers customizable plans, several discounts, and many unique add-on options for almost every homeowners insurance policy. Thus, Travelers is consistently among the top-rated house insurance companies in the country.

Travelers

Pros

- Unique discounts (especially for eco-conscious homes)

- Well established financially

Cons

- Has a banned dog breed list

- High prices for base policies

- Not available in every state

5. Universal Property and Casualty Insurance

Universal Property and Casualty Insurance (or UPCIC) is a fan favorite here at Clovered. UPCIC has a reputation for its quick customer service and claims process, offering several discounts for homeowners insurance policies.

Universal Property and Casualty Insurance

Pros

- Higher-than-average customer service ratings

- Quick to pay out claims

Cons

- Not available in every state

6. Amica Mutual

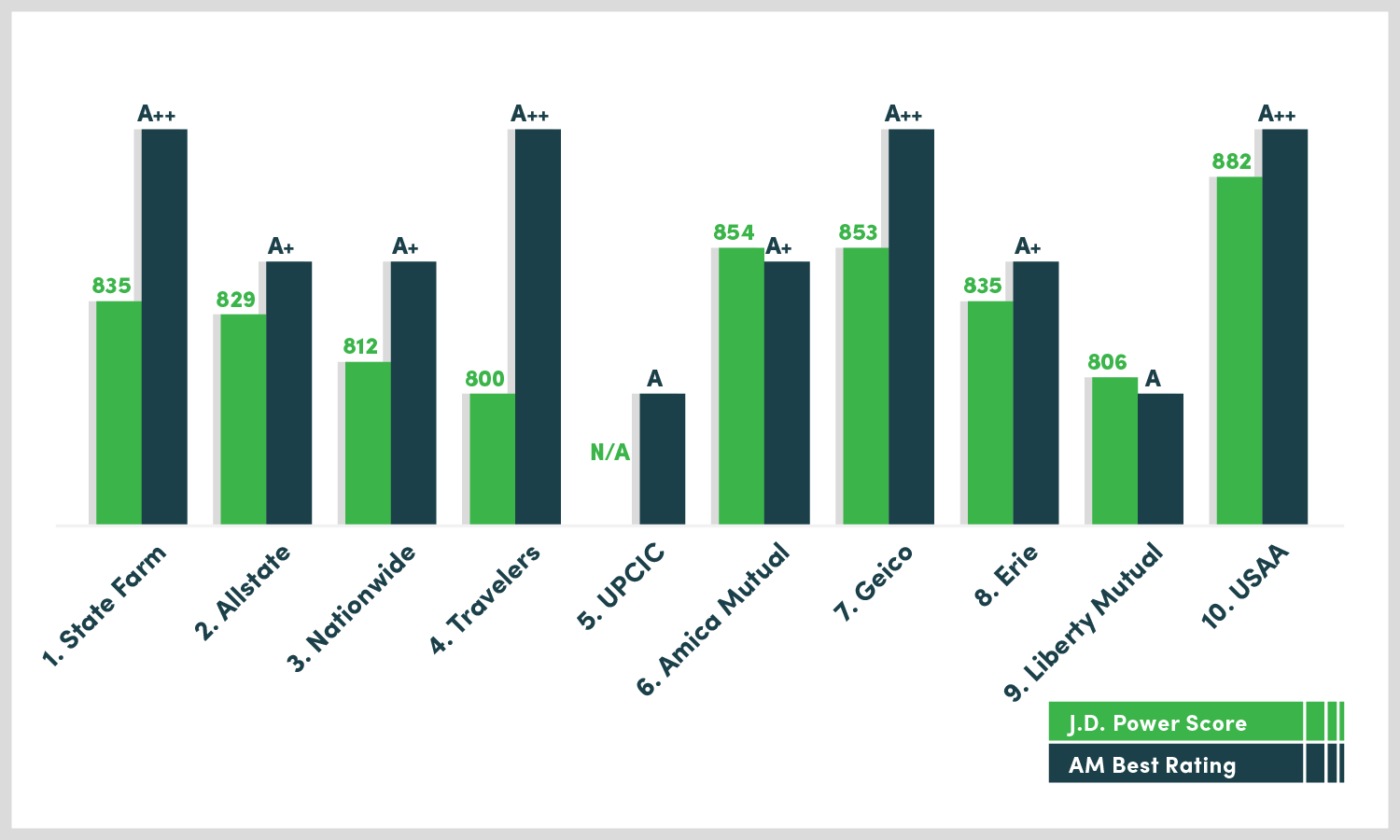

Amica Mutual is most often the provider with the best home insurance reviews. Their policyholders are consistently the most satisfied policyholders in America, leaving Amica with one of the highest JD Powers ratings, at 854/1000.

Amica Mutual

Pros

- Easy-to-use app

- Great customer service

- Dividends program that gives policyholders discounted rates depending on the company’s financial earnings

Cons

- Base policy is more expensive than average

- Only offered in select few states

7. Geico

Geico is one of America’s leading auto insurance providers, but they are also one of the best homeowners insurance companies in the nation. While they use third-party insurers to write their home insurance policies, this allows Geico to be available in all 50 states.

Geico

Pros

- Great discount for bundling home and auto

- Competitive price for base-level coverage

- Many add-ons available

Cons

- Higher-than-average customer complaints

- Uses third-party insurers

8. Erie

Erie is one of the highest-rated home insurance companies, consistently receiving above-average customer satisfaction reports and offering the lowest prices for great coverage. They rank low on our list because they are only available in a handful of states–mainly in the Midwest and Mid-Atlantic regions of the U.S.

Erie

Pros

- Extensive base policies

- Many add-ons available

- Great customer service

Cons

- Not offered in many states

9. Liberty Mutual

Liberty Mutual is one of the nation’s oldest insurance companies, as they’ve been operating for over 100 years. However, they have made changes since their early days, notably their easy-to-use website and app. Liberty Mutual is an excellent pick for a homeowner who wants options, as they have an extensive list of options from coverage types to discounts.

Liberty Mutual

Pros

- Inflation protection to adjust what you pay based on inflation rates

- Several discounts available

- Many add-ons available

Cons

- Low JD Power Score due to issues with the NAIC

- Not available in every state

10. USAA

Our last pick, but certainly not least, is USAA. USAA consistently outranks many of its competitors with its low rates, variety of discounts, and excellent customer service. However, USAA is only available to military veterans and their families. Thus we put them at the bottom of our list for being a members-only option.

USAA

Pros

- Competitively low base-level rates

- Great customer service

- Many discounts available

Cons

- No extended dwellings coverages

- Only available to military families

What Is the Best Home Insurance?

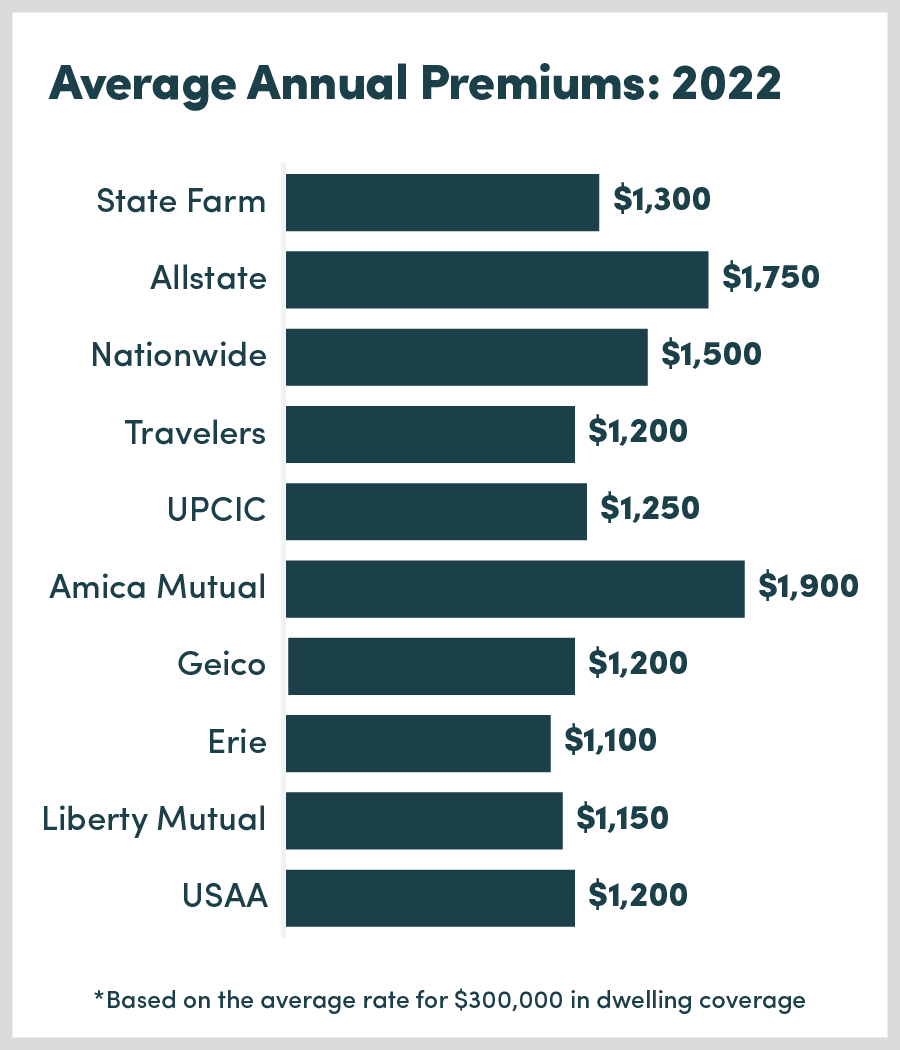

The best home insurance changes from person to person and depends on your specific needs. State Farm and USAA have the best house insurance deals and the lowest base-level policies, but that doesn’t mean these will be the best homeowners insurance companies for you.

When searching for the best homeowner’s insurance for you, you may also want to consider the type of damage that occurs due to weather in your area. Different regions in the U.S. face unique weather circumstances that may cause damage to your home that may be covered with an add-on to your policy.

To find the best home insurance for you, you will want to shop around online to get quotes from several providers. Getting quotes is the best way to assess what provider has the best policy for you and may also help you figure out the discounts for which you may be eligible. Make sure you have some time, though, because getting quotes for homeowners insurance may require you to reference several documents.

You can get the best home insurance quotes here at Clovered by entering your home’s information into our proprietary online quoting tool. If you prefer, you can also contact one of our agents directly by calling 833-255-4117 or emailing [email protected].

It’s Time to Switch Your Homeowners Insurance

We partner with the nation’s top homeowners insurance companies so you can get a custom policy at an affordable price.

Best Homeowners Insurance Rates

Homeowners insurance companies consider many things about you and your home when determining your premiums and what type of coverage they recommend. Typically, the kind of coverage you select, the age and condition of your home, your deductible, and your home location are some of the several factors used in determining the rates you pay for homeowners insurance.

You can get the best house insurance deals by applying discounts to your premiums. Many places offer multi-policy discounts, like Geico, State Farm, and Liberty Mutual, when you take out an auto insurance policy with the same provider. You may also find some providers offering discounts for security systems, updated HVAC systems, or a claim-free record. Some providers offer obscure discounts, too, like Travelers’ eco-conscious discount for homes that swap standard features for eco-friendly ones.

Homeowners Insurance Ratings

If you are new to the insurance world or are switching your policy for the first time, it may be wise to read some homeowners insurance reviews. You can gauge a lot about a provider from the reviews left by policyholders and independent rating agencies.

For example, J.D. Power, a customer insights data collector, assigns homeowners insurance company ratings yearly. J.D. Power bases its ratings on customer satisfaction, cost, the claims process, and several other factors. It is a great, unbiased resource to help guide your search for the best homeowners insurance company for you.

Another example of an independent rating agency is AM Best. AM Best works similarly to J.D. Power, but it’s always in your best interest to consult several sources while researching.

It is important to remember that these independent rating agencies collect data based on objective opinions, not facts. Ultimately, only you know what homeowners insurance policy is best for you and your home.

We partner with the nation's top homeowners insurance companies so you can get a custom policy at an affordable price.

The editorial content on Clovered’s website is meant to be informational material and should not be considered legal advice.

Similar Articles