Wind and Hail Insurance in North Carolina: A Complete Guide

- Homeowner

- /

- Wind and Hail Insurance in North Carolina: A Complete Guide

Homeowners insurance in most places around the country covers wind damage by default. However, coastal North Carolina residents will often find it differently. Home insurance providers exclude wind coverage near the beach, which means these residents must purchase a separate, stand-alone policy for wind and hail insurance in North Carolina.

This guide will cover the details of North Carolina wind and hail insurance in-depth, including rates, requirements, and the specifics of the North Carolina wind pool map.

How North Carolina Wind and Hail Insurance Works

In coastal North Carolina, wind and hail coverage works in one of two ways. Carriers either include it in your homeowners insurance policy by default, or you must purchase a separate policy from a group of insurers known as the Coastal Property Insurance Pool (CPIP).

A typical homeowners insurance policy, formally called the HO3 policy form, will automatically cover hurricanes, wind, and hail as one of its many covered perils, along with other typical damage sources like fires and theft. If hurricane and wind damage are included in your policy coverage, you’ve got nothing extra to worry about and don’t need to seek separate wind and hail insurance.

However, in coastal parts of North Carolina, where the threat of hurricane damage is substantial, most insurers have decided that they don’t want to assume the financial risk or simply can’t afford to cover properties that are (in their eyes) likely to suffer hurricane or wind damage.

So, they offer homeowners insurance without windstorm coverage. Some older homeowners may have HO-8 insurance coverage, specifically designed for older dwellings, where wind and hail insurance likely isn’t included, either.

By excluding wind, hail, and hurricane coverage from their policies, the insurance company is limiting its financial risk. However, this leaves you, the policyholder, still exposed to the peril of wind and hail. So, what can you do?

Understanding the Coastal Property Insurance Pool

The North Carolina government created a program called the Coastal Property Insurance Pool (CPIP) through the North Carolina Insurance Underwriting Association (NCIUA), which established a group of member insurance companies to provide separate wind and hail policies.

The CPIP acts as a market of last resort for homeowners in coastal North Carolina who can’t find wind and hail coverage included in a standard policy. The CPIP will write you a separate wind and hail policy, which is funded by the group of insurers collectively to pool and limit risk. The CPIP will only write you a policy if you already have an existing HO3 policy without windstorm coverage.

Due to this arrangement, carriers in North Carolina can work hand in hand with the NCIUA. So your primary insurer, with whom you have your HO3 policy, can secure the separate CPIP wind and hail coverage for you and also service your claims with the NCIUA if you experience hurricane damage. You may never come in contact with the NCIUA directly.

As of 2023, Allstate, Auto-Owners, Erie, Liberty Mutual, North Carolina Farm Bureau, Nationwide, State Farm, Travelers, and USAA are the largest writers of North Carolina windstorm insurance in beach and coastal zones and thus significant CPIP members.

It’s Time to Switch Your Homeowners Insurance

We partner with the nation’s top homeowners insurance companies so you can get a custom policy at an affordable price.

Is Wind and Hail Insurance Required in North Carolina?

You’re only eligible for a separate wind and hail insurance policy in North Carolina if you live in one of 18 coastal counties on the eastern side of the state. Coverage is only required if you have a mortgage.

Lenders don’t care whether you have wind, hail, and hurricane coverage in your homeowners insurance plan or through a separate policy through CPIP. They just want you to have it to protect their investment in your property.

A lender doesn’t want to risk your house getting damaged or destroyed by a windstorm (or any other peril) because it would mean that they lose the money they’ve put into your house. So, lenders mandate insurance coverage as part of the home loan process, which includes wind coverage.

North Carolina Wind and Hail Insurance Map

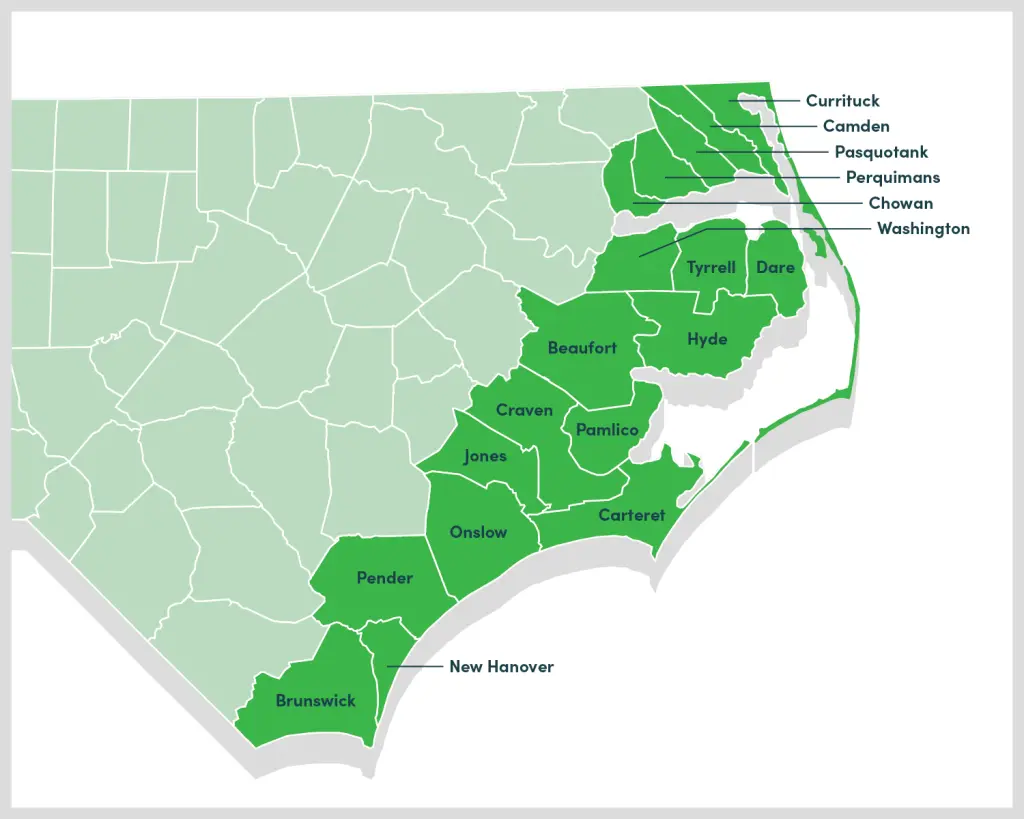

The 18 counties where you may encounter separate wind and hail insurance in North Carolina through CPIP are all on or near the coast, including the Outer Banks. They are Beaufort, Brunswick, Camden, Carteret, Chowan, Craven, Currituck, Dare, Hyde, Jones, New Hanover, Onslow, Pamlico, Pasquotank, Pender, Perquimans, Tyrell and Washington counties.

Since hurricane damage is more prevalent near the coast, where the hurricanes generally arrive from, the risk of damage increases, and insurance rates generally rise as properties get closer to the Atlantic. Such coastal areas are often where people have trouble finding coverage and where the need for separate wind, hail, and hurricane insurance in North Carolina from CPIP is most critical.

For insurance purposes, the General Assembly of North Carolina officially defined the beach areas as all land south and east of the inland waterway from the South Carolina line to Fort Macon (Beaufort Inlet), south and east of Core, Pamlico, Roanoke, and Currituck sounds to the Virginia line, which generally comprises the Outer Banks.

Additionally, the assembly defined all coastal areas as consisting of the above 18 counties depicted in the North Carolina wind pool map. These are the areas where CPIP coverage is available.

If you have a mortgage, there’s no way around the North Carolina wind and hail insurance requirement. If you let your policy lapse during your loan, or you never acquire your own coverage, your lender will find insurance for you. This isn’t a favor. Because it’s in the lender’s best interest, force-placed insurance is almost always more expensive and less comprehensive than protection you can find on your own.

What Does Hurricane Insurance in North Carolina Cover?

A separate North Carolina wind and hail insurance policy covers windstorm and hail damage to your home’s structure and belongings. It can cover damage from hurricanes, tropical storms, hail storms, and other damage caused by high winds and wind-driven debris.

A separate wind and hail insurance policy from CPIP will cover your home for its calculated dwelling value as listed in your primary homeowners insurance policy. For instance, if your house is insured for $300,000 in your HO3 policy, your wind and hail insurance will have the same dwelling limit of $300,000.

In coastal areas, separate wind and hail insurance through CPIP has a maximum residential dwelling coverage limit of $1,000,000 and will cover personal property up to 40% of the dwelling limit amount. Also, since it’s not a stand-alone policy, it likely won’t include liability coverage, which you’ll have through your homeowners insurance.

North Carolina Hurricane Deductibles

Whether your hurricane coverage is included in your homeowners policy or you have a separate wind and hail policy through CPIP, you should note your hurricane deductible. If you have CPIP, this will be the only deductible on the wind and hail policy. If you have wind coverage through your standard homeowners insurance, this deductible will be different from your all-other-perils (AOP) deductible.

Your standard deductible is usually a fixed, arbitrary number, such as $1,000 or $2,000. However, in the event of windstorm or hurricane damage, you will incur your hurricane deductible, which is typically a percentage of your dwelling coverage, often between 1% and 10%.

So, for example, if you have a 2% hurricane deductible and your home is covered for $300,000, your hurricane deductible is $6,000, meaning damage will have to exceed (and you’ll have to pay out-of-pocket) $6,000 before your insurer will step in and cover the rest of the bill after hurricane property damage.

Average Cost of Wind and Hail Insurance in North Carolina

According to our findings, the average cost of homeowners insurance in North Carolina is between $1,639 and $2,136, but this number is almost certainly on the higher end of this range near the coast, and it may not always include windstorm coverage in all instances.

The average cost of stand-alone wind and hail insurance in North Carolina is difficult to estimate because it will vary by property depending on location, home construction, home value, and several other factors.

Generally, larger, more expensive houses and homes closest to the coast or water will have the highest premiums. You should probably expect to pay at least a couple thousand dollars annually for North Carolina wind and hail insurance.

It’s Time to Switch Your Homeowners Insurance

We partner with the nation’s top homeowners insurance companies so you can get a custom policy at an affordable price.

North Carolina Wind and Hail Insurance Rates Explained

Homeowners insurance and wind and hail insurance rates in North Carolina have been on the rise. The extent of rate increases varies by location, with coastal properties receiving the brunt of the load.

Proposed rate increases in beach and coastal areas range from 25.6% in Beaufort, Camden, Chowan, Craven, Jones, Pasquotank, Perquimans, Tyrell, and Washington Counties to 99.4% in beach areas of Brunswick, Carteret, New Hanover, Onslow, and Pender Counties.

Rates likely won’t increase by these full, proposed amounts, but you are likely in store for rising premiums in the coming years due to the prevalent risk of hurricane damage near the coast and rising rebuilding costs due to inflation.

In 2020, the rating bureau filed for a 24.5% rate increase and eventually settled with the state on a 7.9% increase. Coastal North Carolina residents should keep an eye on premiums and continue to shop around for insurance coverage as needed, as rates will likely be in flux for the near future.

Wind and Hail Insurance Discounts

It’s not all bad news, though. You can save money on wind and hail insurance in North Carolina by taking wind mitigation measures and fortifying your home and roof.

The NCIUA encourages policyholders to protect their homes from possible wind damage through wind mitigation, which involves implementing property features that help them withstand wind damage. Some components relate to roof decks, trusses, and hurricane-proof doors and windows.

As of 2023, a total hip roof and opening protections can save you between 8% and 10% on North Carolina wind and hail insurance rates near the coast. You can increase your savings even more by bringing your roof up to FORTIFIED status, a program created by the NCIUA to encourage homeowners to make their homes even more wind-resistant than most building codes demand.

Maximum wind mitigation discounts are between 15.8% and 17.4%, depending on home construction (frame vs. masonry), location, and FORTIFIED status.

How to Get the Best Wind and Hail Insurance in North Carolina

Naturally, you want to secure the best wind and hail insurance in North Carolina. To ensure your coverage amounts are sufficient without having to pay an arm and a leg, you should consult an independent insurance agency that works with several providers and can help you find the right coverage.

At Clovered, we partner with several insurance companies in North Carolina that offer homeowners coverage with wind and hail insurance included. If you want to shop online, you can compare your options and potentially bind coverage with our easy-to-use quoting platform.

Alternatively, if you want assistance throughout the process, our licensed agents are always available during business hours to quote over the phone and answer any questions you may have. Don’t hesitate to give us a call at (833) 255-4117 or email us at agent@clovered.com.

We partner with the nation's top homeowners insurance companies so you can get a custom policy at an affordable price.

The editorial content on Clovered’s website is meant to be informational material and should not be considered legal advice.