What Is a Homeowners Insurance Declaration Page?

- Homeowner

- /

- What Is a Homeowners Insurance Declaration Page?

A homeowners insurance declaration page is essentially a brief overview of your policy. It identifies some key information that interested parties may want to know at a glance. Let’s go over all the information that’s on a homeowners insurance declaration page in-depth, including what important details you won’t find on it. And, let’s find out when you might need your declaration, or dec, page.

What Is a Homeowners Insurance Declaration Page?

A homeowners insurance declaration page summarizes the main information about your protection, like coverages and limits. It also lists details about the policyholder, like your name, address, and mortgage lender (if you have one). Starting from the top of the document, let’s go over the pieces of information in depth:

The Top of the Dec Page

Named Insured: On your policy, the named insured should be you, the policyholder. Additional insureds may also appear here if you have any. The insured address, which is your address, will be somewhere around your name, too.

Agent/Insurer: Your insurance company and agent should be listed at the top near your name and address with some contact information.

Policy number and period: Your policy number is for logistical and identification purposes. Your policy period is the length of your policy, also known as the effective dates. Policies are usually six months or a year long.

Lender information: If you have a mortgage on the insured home, your mortgage lender will need to be on your policy. Your lender usually appears somewhere at the top of the document, although they may be listed at the bottom, too.

Your mortgage company is on your insurance because as a primary investor in your property, they need to make sure that their investment is protected by guaranteeing you maintain coverage. If the policy was to lapse or get canceled, your lender would know.

Also, having your mortgage company listed on your policy typically makes them the loss payee after a potential claim. This means that if your home sustained damage and your insurance carrier reimbursed you for repairs, the check would initially go to your mortgage company.

The Middle of the Dec Page

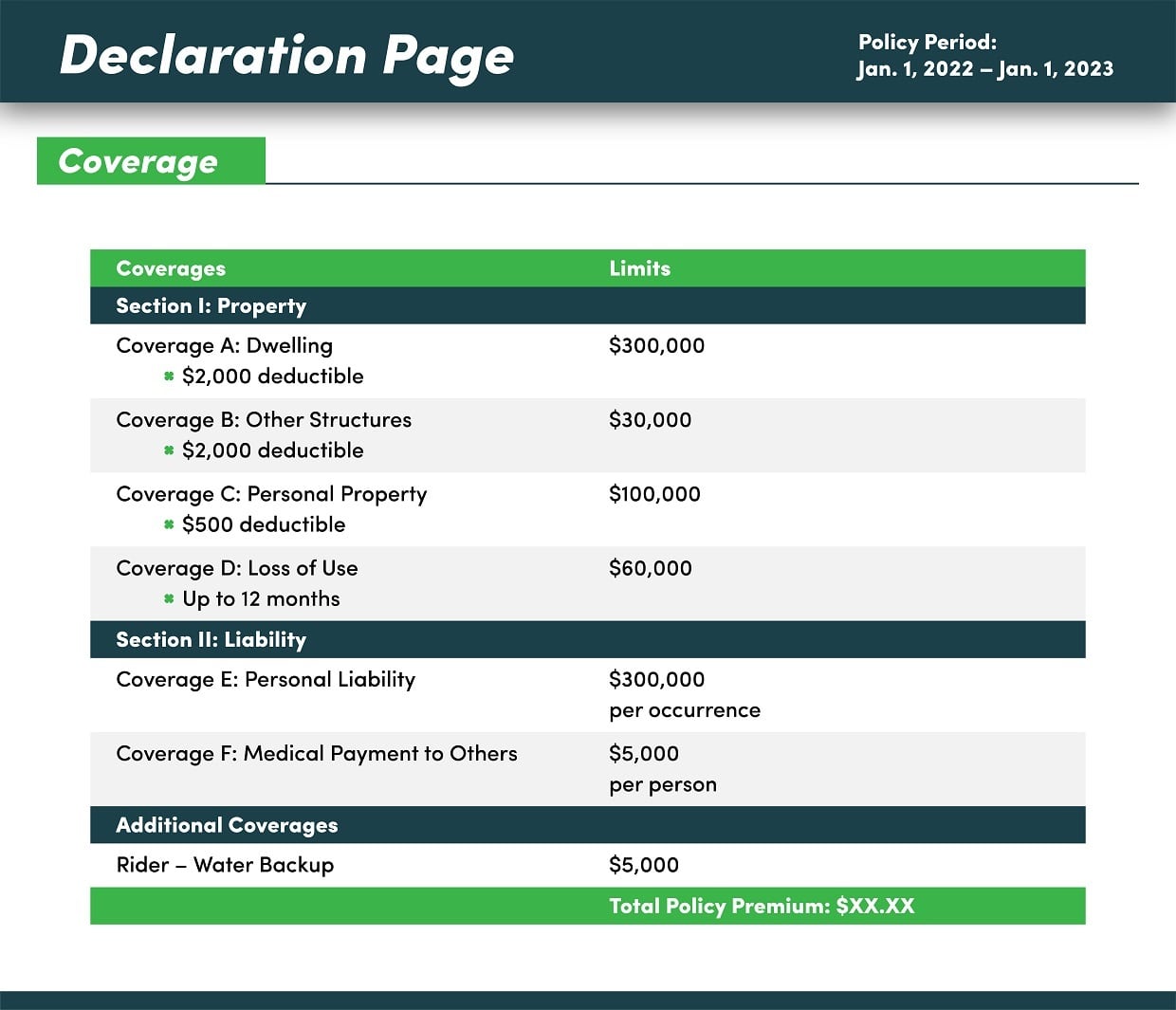

After the information about you as a policyholder, you start getting into the meat of the dec page. Your coverages and corresponding limits are usually listed here. A homeowners policy has different areas of coverage: dwelling, other structures, personal property, and loss of use all concern your home and its value. Liability and medical payments coverage safeguard your financial wellbeing in case of accidents.

Some declaration pages will separate the listing of your coverages into sections, one for property and one for liability. Regardless, all coverages should be listed, and the limits you chose for each type of coverage should appear alongside them. Note that medical payments may not be listed since it’s relatively small compared to the rest of the protections you have.

You should also see your deductible somewhere around here. Your home insurance deductible is the amount you’re responsible for paying when you file a claim. Think of it as the minimum amount of damage you need to incur before your insurer steps in to cover the rest of the costs.

Common homeowners deductibles are between $500 and $2,500, but you may choose a higher one depending on how much you’re comfortable paying out of pocket. Oftentimes, you can opt for a higher deductible to lower your yearly premium.

Your declaration page may also list whether you have replacement cost coverage or actual cash value coverage for a section of your insurance. You might see this around your personal property limit, for instance.

Relating to personal property coverage, replacement cost coverage means your insurer will reimburse you exactly what you paid for damaged belongings no matter how old they may be. Actual cash value, on the other hand, means your provider will factor in depreciation before reimbursing you. So, the older an item is, the less you’ll be paid for it. As a result, actual cash value is usually the cheaper option since it almost always provides smaller payouts than replacement cost coverage.

We partner with the nation’s top homeowners insurance companies so you can get a custom policy at an affordable price.

The Bottom of the Dec Page

After your coverages have been laid out, you’re likely to see any discounts you qualify for and possibly any additional coverages you purchased near the bottom of the homeowners insurance declaration page. You may also see any state-specific requirements insurance companies must comply with, as well as additional contact information.

Discounts lower your premium. Carriers offer all different types of discounts, and the ones you may qualify for vary by company. That’s one of the reasons why it’s so important to shop around for homeowners insurance and get multiple quotes. You never know the ways you might save. Common discounts include for bundling, being claims-free, and buying a new home.

Insurance companies also offer several types of endorsements, which are optional add-ons, to supplement coverage for sources of damage that may be excluded by default. For example, you may purchase a mold damage endorsement or a sewage overflow endorsement.

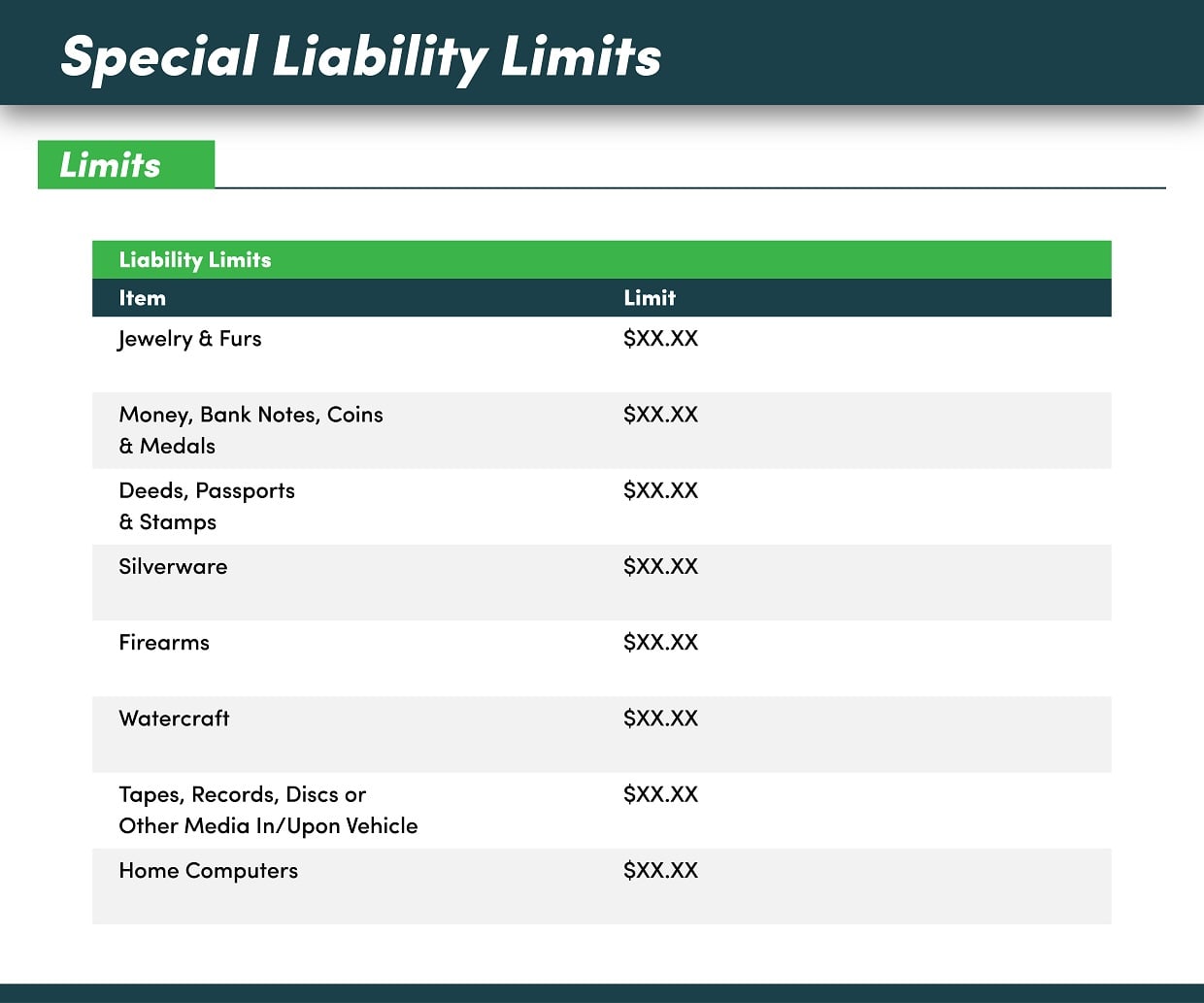

You may also purchase riders to up your coverage beyond standard coverage limits. For instance, a home insurance policy may have a sub-limit for jewelry at $5,000. If you have more than $5,000 worth of jewelry, you can pay for added protection.

Your endorsements and riders may be printed at the bottom of the dec page, too.

You also might see any state surcharges or taxes specific to your state, if applicable. Although this may seem unfair that you have yet another expense, the good news is that surcharges usually aren’t more than a few dollars. Florida, for example, has a state surcharge of $2.00. Kentucky makes insurers collect a state tax of $1.80 on policies.

You may also see at the very bottom of the document more contact information for your insurance company or lender, such as a mailing address, or their social media information.

What Is Not On A Homeowners Insurance Declarations Page?

It’s important to remember that the declarations page of a home insurance policy is just an overview of your coverage. There’s a reason a policy is typically dozens of pages long. Policy exclusions, conditions for filing claims, and extensive lists of definitions all need more room to be explained. They won’t be found on the dec page.

Insurance companies don’t cover all types of damage. Most homeowners insurance policies include a list of covered perils. Beyond these covered sources of damage, the insurance company explains when and why you may not receive coverage in your policy’s exclusions.

Typical exclusions include damage caused by policyholder negligence, earth movements, and some forms of water damage. There are many more times when your insurance company may not cover damage to your home, though, and you need to read through your policy’s exclusions to find out.

Additionally, your insurance company will likely outline claims procedures in your policy. For instance, your provider may state that you need to act as soon as possible for losses to be covered, and they may spell out the consequences of not acting truthfully or misrepresenting damage. They may also mention their procedures regarding company adjusters.

And, your carrier will be sure to thoroughly define everything in your policy, including what’s on the declarations page. There’s usually a list of definitions on the first few pages after the dec page, but there will surely be many instances throughout the policy where the company will clarify what they mean when they use certain terms. There is little room for uncertainty in an insurance plan.

You’ll also find privacy statements, company guidelines, and governmental disclosures throughout a policy. Be sure to ask your insurer if there’s anything you want them to clear up. You should review your declarations page, as well as the whole policy, to make sure there’s nothing incorrect or unexpected in your coverage, as well.

Where Can I Find My Homeowners Insurance Declaration Page?

The homeowners insurance declaration page is usually one of the first pages of the policy. You should receive one when you get your policy, and you may get one every time you renew or make changes to your plan.

You can also typically access your dec page through your account on your insurance company’s website or app. It may be located in a “Documents” tab, or something similar. It hopefully comes up as a PDF, and you may want to print or download it to have for your records.

Your insurer should also be able to send you one electronically or through the mail if you ask them to.

Homeowners Insurance Declaration Page for Mortgage

One of the most common times you may need your homeowners insurance declaration page is when you’re getting a mortgage or buying a house. Your mortgage lender will usually always require an up-to-date declarations page to verify your maintaining coverage on your house. This protects their (and your) investment.

Your insurer may automatically send your lender a copy of your dec page every time you renew your policy. Or, your mortgage company may ask you to send them an updated one about once a year.

If you don’t provide your lender with proof of insurance, they can purchase homeowners insurance for you. This isn’t in your best interest, as the force-placed insurance the mortgage company will buy for you often comes with higher rates than policies you could get for yourself.

We partner with the nation's top homeowners insurance companies so you can get a custom policy at an affordable price.

The editorial content on Clovered’s website is meant to be informational material and should not be considered legal advice.