Cheapest Car Insurance Rates by State for 2025

- Auto

- /

- Cheapest Car Insurance Rates by State for 2025

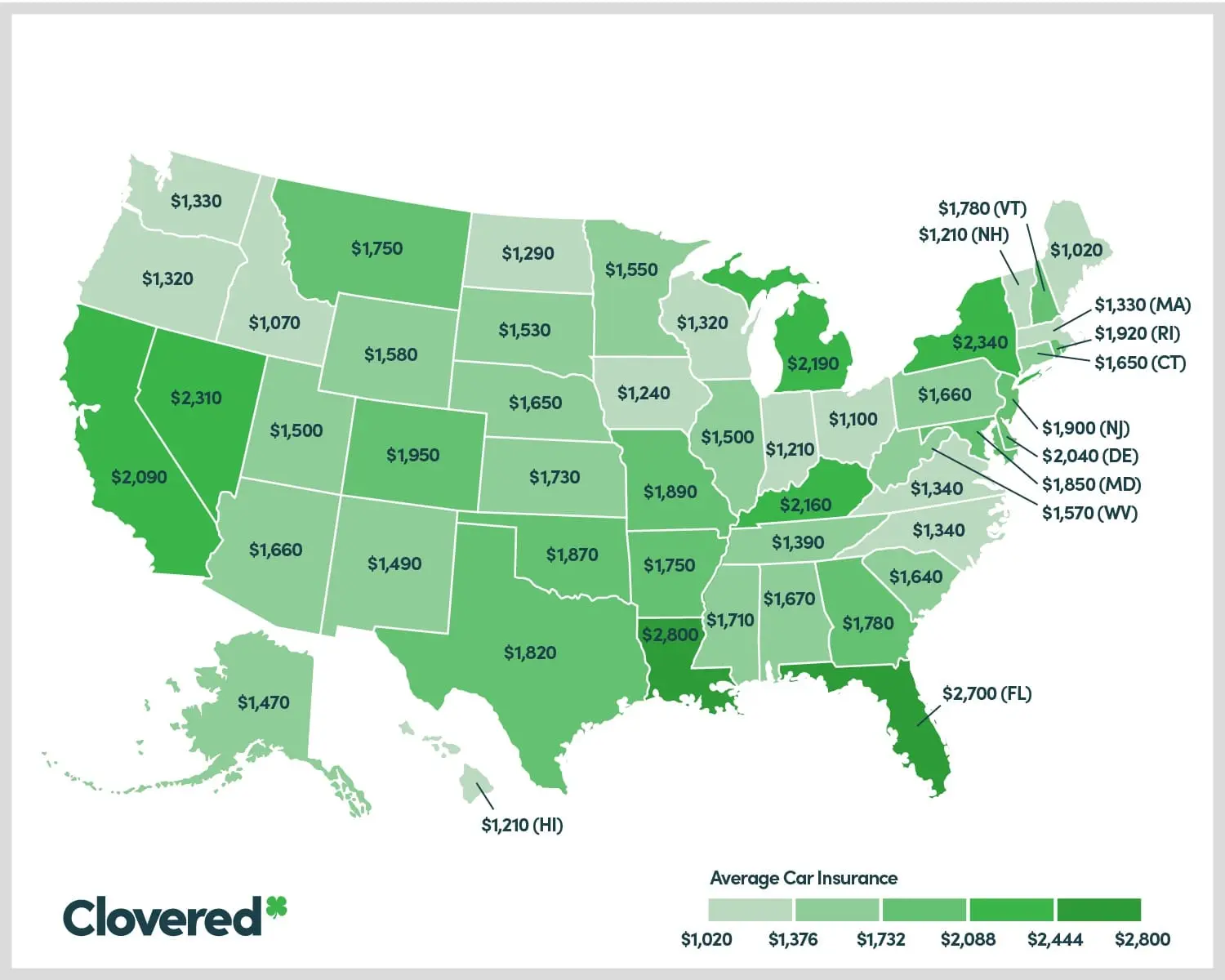

Several factors determine what you pay in auto insurance premiums, the biggest of which is the state in which you’re insured. Car insurance rates by state are vastly different, and they can even vary by ZIP code if that’s permitted in your state.

Nationally, the average American pays about $2,160 annually for a full coverage policy and about $643 annually for a liability-only policy. However, these rates may be much higher or lower than what’s available, depending on where you live. Keep reading to find out more about the cost of auto insurance by state, the states with the cheapest car insurance, and the highest car insurance rates by state.

Car Insurance Rates by State

Car insurance costs by state can vary significantly because of different laws, driving behaviors, the number of uninsured drivers, and road conditions. Each of these factors leads to a rise in claims, which, in turn, increases premiums.

For example, drivers in no-fault states like Michigan, New York, and Florida typically pay more for their car insurance premiums than the average American. While no-fault laws intended to lower the costs of car insurance premiums, the outcome was, unfortunately, the opposite.

Driving behaviors also vary by state, which often impacts the prices residents pay in premiums. For example, drivers in New York state pay higher premiums because of the driving behaviors of residents in New York City. In such a densely populated city, it’s only natural that there are higher rates of car accidents, uninsured drivers, and poor road conditions, which causes the premiums to rise for residents of the whole state.

In contrast, insurance rates in states like Iowa, Indiana, and New Hampshire tend to fall near or below the national average. These are the cheapest car insurance states because they don’t have densely populated cities, which translates to fewer uninsured drivers, better driving behaviors, and better road conditions compared to states with high car insurance premiums.

Average Cost of Car Insurance by State

The average car insurance prices by state can stray far from the national average of $1,668 annually, depending on where you live. While car insurance costs by state can vary based on location, they may also vary based on what insurers are available in your state. Let’s look at the average annual cost of full coverage auto insurance per state.

| Average Cost of Car Insurance By State | ||

| State | Yearly Premium | Monthly Premium |

| Alabama | $2,038 | $170 |

| Alaska | $1,884 | $157 |

| Arizona | $2,134 | $178 |

| Arkansas | $2,273 | $189 |

| California | $2,369 | $197 |

| Colorado | $2,665 | $222 |

| Connecticut | $2,114 | $176 |

| Delaware | $2,426 | $202 |

| Florida | $3,750 | $313 |

| Georgia | $2,495 | $208 |

| Hawaii | $1,657 | $138 |

| Idaho | $2,000 | $167 |

| Illinois | $1,652 | $138 |

| Indiana | $1,600 | $133 |

| Iowa | $1,401 | $117 |

| Kansas | $2,118 | $177 |

| Kentucky | $2,510 | $209 |

| Louisiana | $3,516 | $293 |

| Maine | $1,731 | $144 |

| Maryland | $2,599 | $217 |

| Massachusetts | $1,489 | $124 |

| Michigan | $2,855 | $238 |

| Minnesota | $2,211 | $184 |

| Mississippi | $2,508 | $209 |

| Missouri | $2,073 | $173 |

| Montana | $2,119 | $177 |

| Nebraska | $1,602 | $134 |

| Nevada | $1,866 | $156 |

| New Hampshire | $2,255 | $188 |

| New Jersey | $2,123 | $177 |

| New Mexico | $3,275 | $273 |

| New York | $1,805 | $150 |

| North Carolina | $1,836 | $153 |

| North Dakota | $2,731 | $228 |

| Ohio | $1,402 | $117 |

| Oklahoma | $2,389 | $199 |

| Oregon | $1,754 | $146 |

| Pennsylvania | $2,513 | $209 |

| Rhode Island | $2,736 | $228 |

| South Carolina | $2,253 | $188 |

| South Dakota | $2,087 | $174 |

| Tennessee | $1,931 | $161 |

| Texas | $2,705 | $225 |

| Utah | $1,941 | $162 |

| Vermont | $1,702 | $142 |

| Virginia | $1,309 | $109 |

| Washington | $1,794 | $150 |

| Washington, D.C. | $2,635 | $220 |

| West Virginia | $1,967 | $164 |

| Wisconsin | $1,925 | $160 |

| Wyoming | $1,459 | $122 |

Cheapest States for Car Insurance

While car insurance rates change yearly depending on the economic state of the U.S., some states consistently pay less in car insurance premiums than others. The states with the cheapest car insurance are Virginia, Iowa, Ohio, Wyoming, and Massachusetts.

| 10 Cheapest States For Car Insurance | ||

| State | Yearly Premium | Monthly Premium |

| Virginia | $1,309 | $109 |

| Iowa | $1,401 | $117 |

| Ohio | $1,402 | $117 |

| Wyoming | $1,459 | $122 |

| Massachusetts | $1,489 | $124 |

| Indiana | $1,600 | $133 |

| Nebraska | $1,602 | $134 |

| Illinois | $1,652 | $138 |

| Hawaii | $1,657 | $138 |

| Vermont | $1,702 | $142 |

There are many reasons why these are the cheapest car insurance states, many of which are interconnected and complex. For example, all the states that have the least expensive auto insurance ranking by state have low populations. When a state isn’t densely populated, there are fewer uninsured or underinsured motorists on the road, fewer thefts and accidents, and the roads are typically in better condition because they’re used less in comparison to other more densely populated states.

While these states have, on average, the lowest auto insurance rates by state, that doesn’t mean you will qualify for their low average prices. Insurers determine your premiums by looking at several unique factors, like your age, gender, driving record, credit score, and various other factors.

Similarly, the lowest auto insurance rates by state don’t reflect the lowest rates available in your state. You may qualify for an even lower price than your state’s average premium if you investigate what types of discounts your insurer offers. Many auto insurance companies offer discounts for students, good drivers, policyholders who have multiple policies with the same insurer, and those who have multiple cars on one auto insurance policy.

What’s the Cheapest State for Car Insurance?

From our calculations, the cheapest state for car insurance is Virginia, with the average annual premium for a full coverage policy costing residents about $1,309. This cost, of course, doesn’t reflect what all residents pay for their car insurance policies, as some will pay more, and some will pay less depending on their driving behaviors and financial situations.

Most Expensive States for Car Insurance

Car insurance rates change yearly based on various factors at the national and state levels. Still, a handful of states typically remain the states with the most expensive car insurance premiums. Florida, Louisiana, New Mexico, Michigan, and Rhode Island are the most expensive car insurance states. On average, residents in these states pay more than $2,500 annually for full coverage car insurance policies.

| 10 Most Expensive States For Car Insurance | ||

| State | Yearly Premium | Monthly Premium |

| Florida | $3,750 | $313 |

| Louisiana | $3,516 | $293 |

| New Mexico | $3,275 | $273 |

| Michigan | $2,855 | $238 |

| Rhode Island | $2,736 | $228 |

| North Dakota | $2,731 | $228 |

| Texas | $2,705 | $225 |

| Colorado | $2,665 | $222 |

| Washington, D.C. | $2,635 | $220 |

| Maryland | $2,599 | $217 |

The population is primarily to blame for the cost of car insurance premiums in these states. Florida and Texas are two of the most populated states, meaning they have a higher percentage of uninsured or underinsured motorists on the road. With a higher population also comes more drivers, which means more accidents, claims, and generally poor road and traffic conditions.

Another factor that increases car insurance premiums is no-fault laws. While Michigan’s population doesn’t compete with Florida’s, Michigan is a no-fault state. No-fault laws were designed to protect drivers in the event of an accident with an uninsured or underinsured motorist and require policyholders to have a coverage called personal injury protection (PIP).

No-fault laws were created to lower the cost of car insurance premiums in states with high populations or high populations of uninsured or underinsured motorists, but they had the opposite effect. Florida and Michigan are both no-fault states.

The reason Louisiana is one of the most expensive states for car insurance is unrelated to its population but has to do with laws. In Louisiana, the statute of limitations for claims is one year. This equates to more yearly claims if people want to see their claims paid out. A high number of claims always makes insurance premiums more expensive.

Compare Car Insurance Rates by State

If you’re interested in comparing your car insurance rates by state, or finding the cheapest car insurance by state, the easiest way to do so is by getting free quotes online. We can help you with that. By using our free quoting tool right here at Clovered, you can input your information and see if you are getting auto insurance for the lowest cost in your state. If you prefer to speak to someone directly, you can call us at 833-255-4117 or email us at agent@clovered.com.

Rethink your auto insurance premium with a free quote from the nation's top companies.

The editorial content on Clovered’s website is meant to be informational material and should not be considered legal advice.

Similar Articles