How to Read Your Homeowners Insurance Policy

- Homeowner

- /

- How to Read Your Homeowners Insurance Policy

While it’s certainly not an exciting prospect, knowing how to read your homeowners insurance policy is crucial so you know what’s covered and uncovered when you need to file a claim.

Use this guide below, where we make understanding homeowners insurance policies easy by breaking each section of a typical plan.

How to Read Your Homeowners Insurance Policy

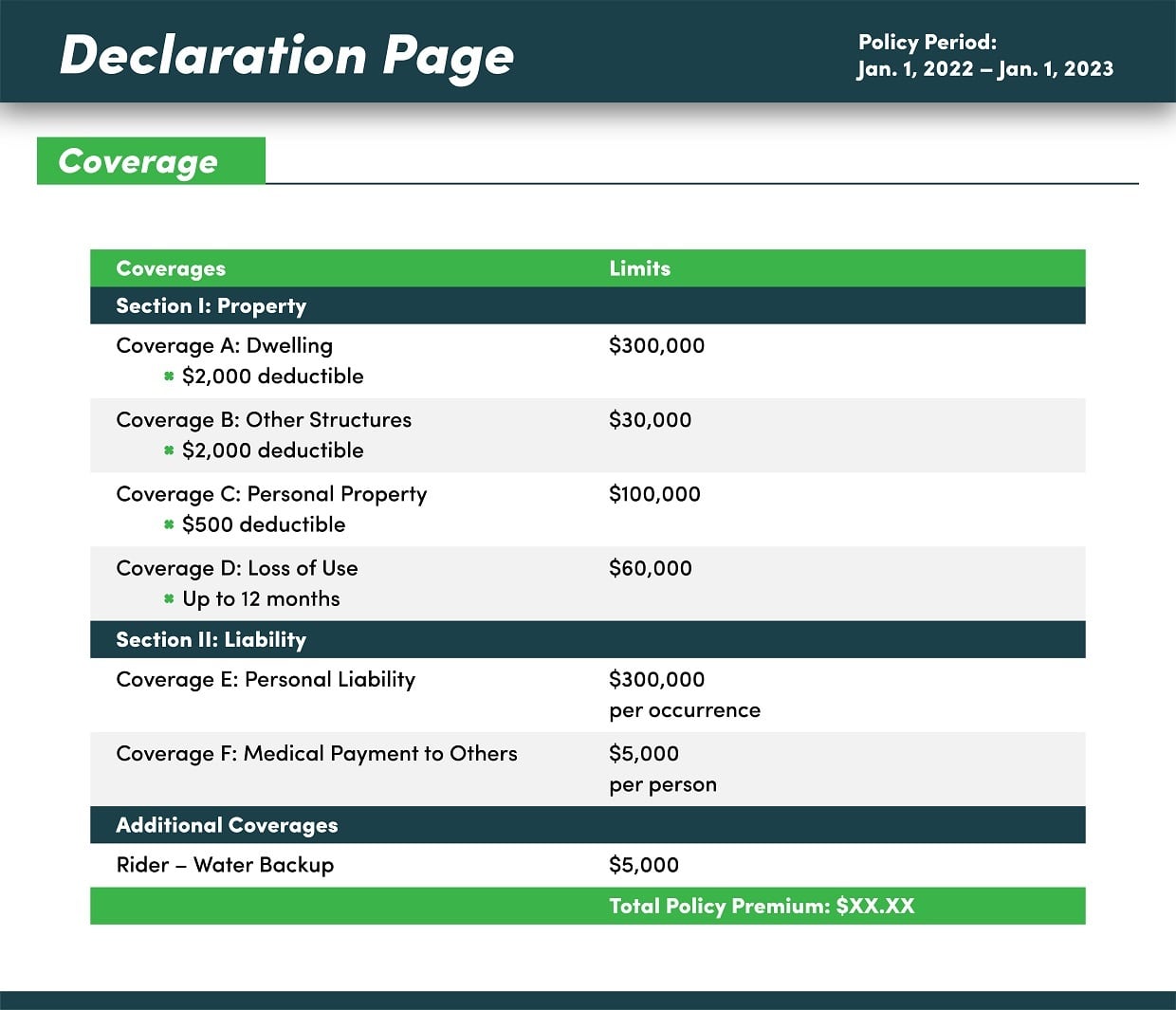

A homeowners insurance policy starts with a declarations page, which summarizes your coverages, discounts, and deductibles. In the many pages that follow, your policy will explain your coverages in different sections, specify exclusions, and notify you of any endorsements or provisions from your state or carrier in detail.

In insurance, the different types of policies available to protect your property are called HO forms. HO1, HO2, and HO3 forms are all types of homeowners insurance. HO3 policies are the most inclusive and common of the three, so we’ll mainly be referring to HO3 policies when discussing how to read your homeowners insurance, although HO1 and HO2 plans may be largely similar, albeit shorter.

A common HO3 homeowners insurance policy contains:

- Declarations page

- Definitions

- Property coverages and limits

- Perils insured against

- Exclusions

- Additional protections

- Conditions

- Company and state provisions

- Privacy statements and disclosures

Note that perils insured against, exclusions, additional protections, and conditions may be listed more than once since they can vary depending on the type of property coverage they apply to.

The Declarations Page

You’ll notice immediately that your homeowners insurance policy is rather long. The exact length will vary based on your insurance company, but it’s likely over 20 pages. Don’t fret, though, as much of the policy is summarized early on in your declarations page. It’s typically one of the first pages in your plan.

A dec page is a summary of what’s contained in your policy so you can see some of the most important information at a glance. Your dec page will list the following:

- Policyholder name and address

- Insurance company name and address

- Agent name, if applicable

- Effective date

- Lender information

- Policy coverages and limits

- AOP deductible

- Discounts

- Endorsements, if applicable

Much of the information on the declarations page will be explained in further detail later in the policy, except your lender information. When you’re buying a house or getting a mortgage, your lender will usually want a copy of your dec page, so they know you got or are maintaining coverage on your property.

The dec page is probably the most straightforward part of your plan. The information should be listed clearly and often in chart form. For instance, there may be a column for your coverages, which usually lists the corresponding limit to the right of it in another column.

As you go down the page, your discounts and endorsements and how much they add or subtract from your overall premium should be listed, too. At the bottom, you may see your final premium – the amount you have to pay.

Homeowners Insurance Definitions Page

Soon after your declarations page, you should find a page of definitions. It will look sort of like a dictionary. It will list and define terms that will be used often later on in the policy.

Some common terms included in the homeowners insurance definition page include:

- Bodily injury

- Business

- Named insured

- Residence premises

- Insured premises

- Motor(ized) vehicle

There will be many more terms than these. If you have questions about any of them, be sure to ask your provider or agent.

These terms aren’t hard to understand in general, but they may be used in a certain way by your insurer in the policy, so they want you to understand that. Plus, they need to list the definitions so there can be no gray areas when a claim occurs.

Property Coverages

After the list of definitions, the property coverages are usually explained. The property coverages your policy will describe are your:

- Coverage A – dwelling coverage

- Coverage B – other structures coverage

- Coverage C – personal property coverage.

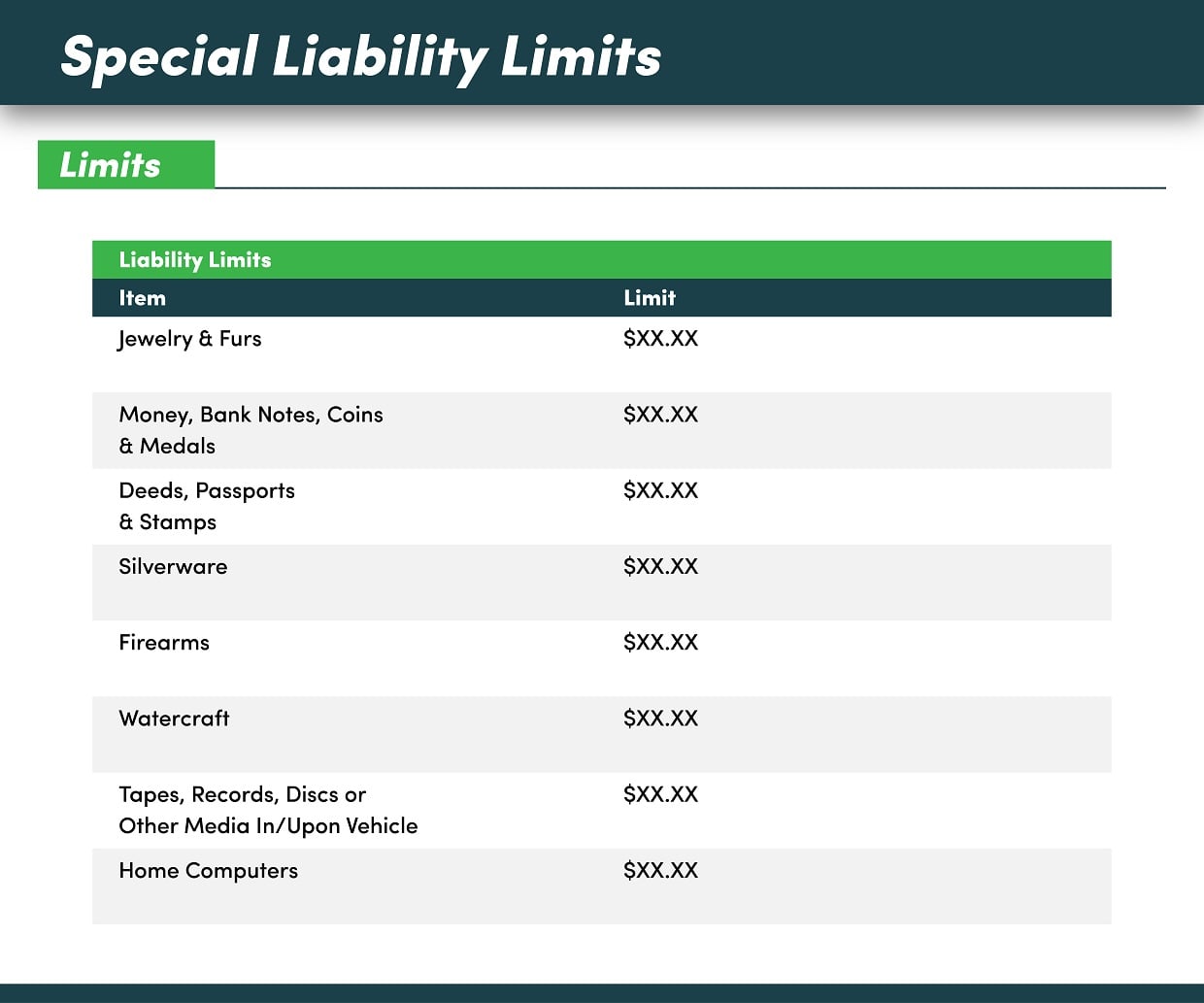

These coverages and what they entail will be explained in detail. Your plan should give some examples of what’s covered and not covered. In the personal property section, your policy will likely outline sub-limits you have.

Your insurance company caps the amount you can receive for certain belongings, such as watercraft, jewelry, silverware, trading cards, art, and more.

You can raise or negate sub-limits in your plan with scheduled personal property coverage, which would be reflected later in your plan. With scheduled personal property coverage, you designate certain items that you want your insurer to cover wholly. This is optional and will raise your premiums.

It’s Time to Switch Your Homeowners Insurance

We partner with the nation’s top homeowners insurance companies so you can get a custom policy at an affordable price.

Perils Insured Against

After your insurer describes the property coverages you have, they’ll usually list what you’re protected from with these coverages. These potential sources of damage, often called perils, will be laid out in the perils insured against (or similarly named) section.

The typical perils insured against in an HO3 policy are:

- Vandalism

- Theft

- Frozen pipes

- Damage caused by vehicles

- Damage caused by aircraft

- Rioting or civil disturbances

- Fire or lightning

- Windstorms or hail, such as a hurricane or tornado

- Damage from smoke

- Damage caused by heating, air conditioning, or plumbing

- Damage due to snow, ice, or sleet

- Damage from a water heater, including cracks, burns, or tears

- Damage from electrical currents, such as downed powerlines

- Explosions

- Falling objects

- Volcanic eruptions

These can vary depending on your policy, provider, and location. Whatever perils you’re covered from will be explained.

For instance, when you see “theft” listed, you may see an explanation after it describing what constitutes theft for your insurance company, such as “ loss of property from a known place when it is likely that the property has been stolen.

Your plan might then note some instances where theft might not be covered with wording like “this peril does not include loss caused by theft committed by an ‘insured’” or “this peril does not include loss caused by theft In or to a dwelling under construction.”

Exclusions

Your policy will outline exclusions that aren’t named in your perils insured against. Your insurance company won’t cover property damage caused by anything listed under your exclusions. Common potential sources of damage you’ll find under exclusions are:

- Flooding

- Water backup

- Earth movement

- Damage from an insured

- Damage from war

- Power failure

- Construction-related damage, like faulty workmanship

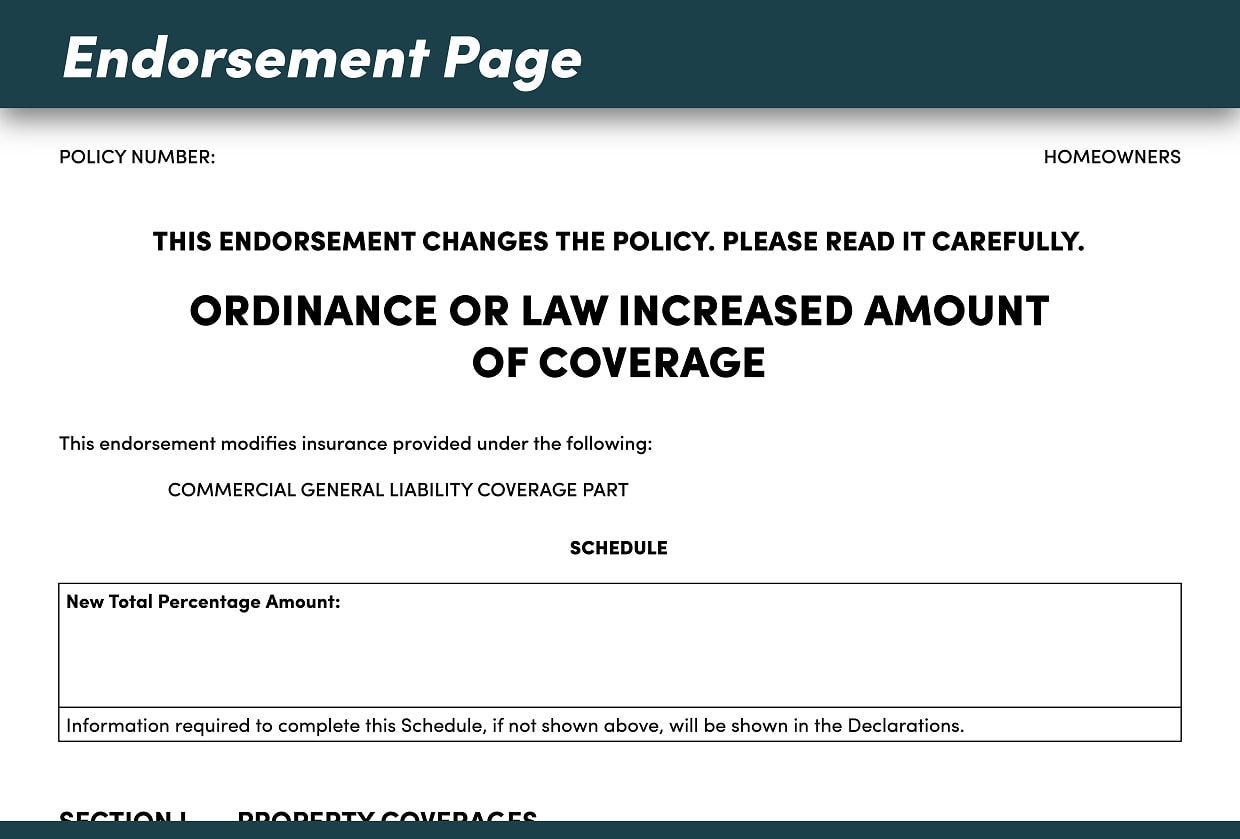

You can sometimes negate an exclusion by purchasing an endorsement to cover it. For example, most insurers offer a water backup endorsement. If you get one of these endorsements, it will be reflected later in your policy, acknowledging your coverage for that peril.

Additional Protections

Your policy may have a section after your exclusions that outlines protections in your plan that don’t fall under regularly covered perils. Here, you may see how your insurance company covers debris removal, reasonable repairs, landscaping, and more.

You may also see an explanation of your loss of use, or additional living expenses, coverage. This coverage comes into play if you’re forced to move out of your house due to damage from a covered peril.

Liability Coverages

After your property coverages are explained, your provider will explain how they protect your financial liability. Your liability coverage usually encompasses:

- Coverage E – liability coverage

- Coverage F – medical payments coverage

Both coverages involve reimbursement of medical expenses and potential legal fees in case someone gets hurt on your property. As with the property coverages section, your provider may detail some exclusions and additional protections after describing how you’re covered.

For example, your provider could outline when you’re eligible to receive such payments. And, they may mention the duties of an injured person, how they proceed with a claim, and other technical aspects of a liability claim.

Conditions

The conditions section of your policy usually comes near the end. Here, your provider will explain some processes related to claims or the application of your policy. For instance, they may describe the concept of insurable interest, loss payments, your duties after a loss, appraisals, and more.

While it doesn’t relate directly to your coverage or covered perils, the conditions section still has some important information. For example, in this section, your insurer could explain how they communicate with your mortgage lender or what happens when you cancel your policy.

Privacy Statements and Disclosures

Some policies will conclude with privacy statements and other similar disclosures. Your provider may state how they use and protect your information or tell you in writing that they need to check your credit report before giving you coverage.

How Many Parts Are in a Home Insurance Policy?

How many parts there are in your home insurance policy varies by company. But, generally, you’ll have an explanation of the six different coverages, a section for exclusions, a section for endorsements, and parts at the end about conditions, disclosures, and more.

Technically, the coverages are divided into property and liability coverages, so some policies will have them sorted under these categories. Other companies may dedicate larger sections with different explanations for each coverage.

Some insurance companies may also have state-specific disclosure requirements or other parts at the end of the plan. For instance, some southern states will likely include an explanation of hurricane deductibles somewhere in the policy. In contrast, states that don’t have to worry about hurricanes won’t have such a disclosure.

Some providers may also have different paperwork at the end of their plans regarding contacting them, filing claims, and more. The main parts of a home insurance policy won’t change much, but optional add-ons and state and company-related pages may increase length.

How Do I Get a Copy of My Homeowners Insurance Policy?

You should always be able to ask your insurance provider or agent to get a copy of your homeowners insurance policy. Many companies email or mail it to you just after binding.

In many cases, when someone asks for proof of insurance, a copy of your dec page will suffice. But, you should always have a copy of your whole insurance policy on hand, too, just to be safe. If you want a copy of your plan, you may be able to access it online through your provider’s mobile app or website.

If not, call your agent or insurance company and ask them directly for a copy of your policy. They should be able to produce it for you. Part of understanding homeowners insurance is understanding your right to contact your provider and ask questions you want the answer to. A copy of your policy can help you do that.

We partner with the nation's top homeowners insurance companies so you can get a custom policy at an affordable price.

The editorial content on Clovered’s website is meant to be informational material and should not be considered legal advice.

Similar Articles

6 Min Read

6 Min Read